Social Security Max 2025 Contribution. The highest benefit for those who qualify and delay. This is up from $9,932.40.

In 2025, you paid social security taxes on work income up to $160,200. For 2025 come january 2025, the final phase of hikes takes effect.

2025 Social Security Maximum Withholding Marna Shelagh, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration.

Social Security Benefit Increase 2025 Verna, The maximum social security benefit in 2025 is $3,822 per month at full retirement age.

Maximum Sss Contribution 2025 Dalia Eleanor, In 2025, the contribution and benefit base is $168,600.

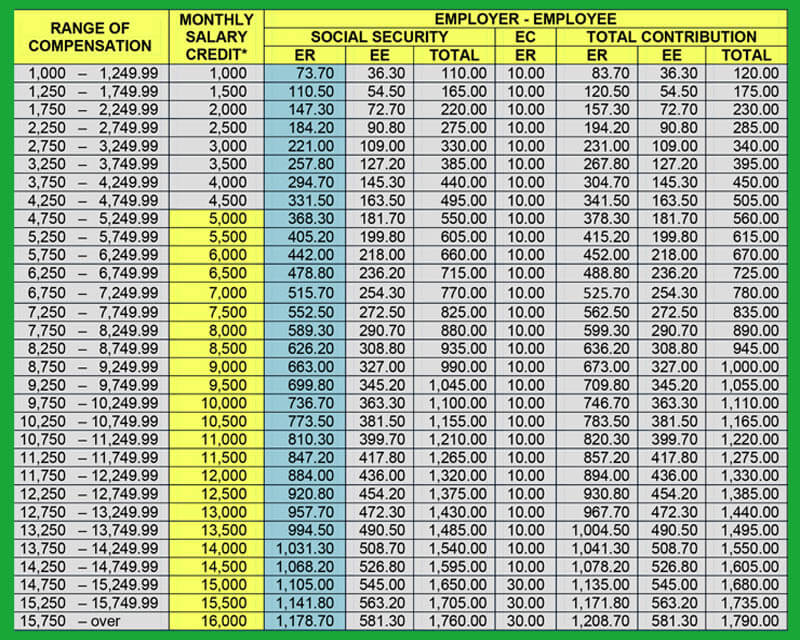

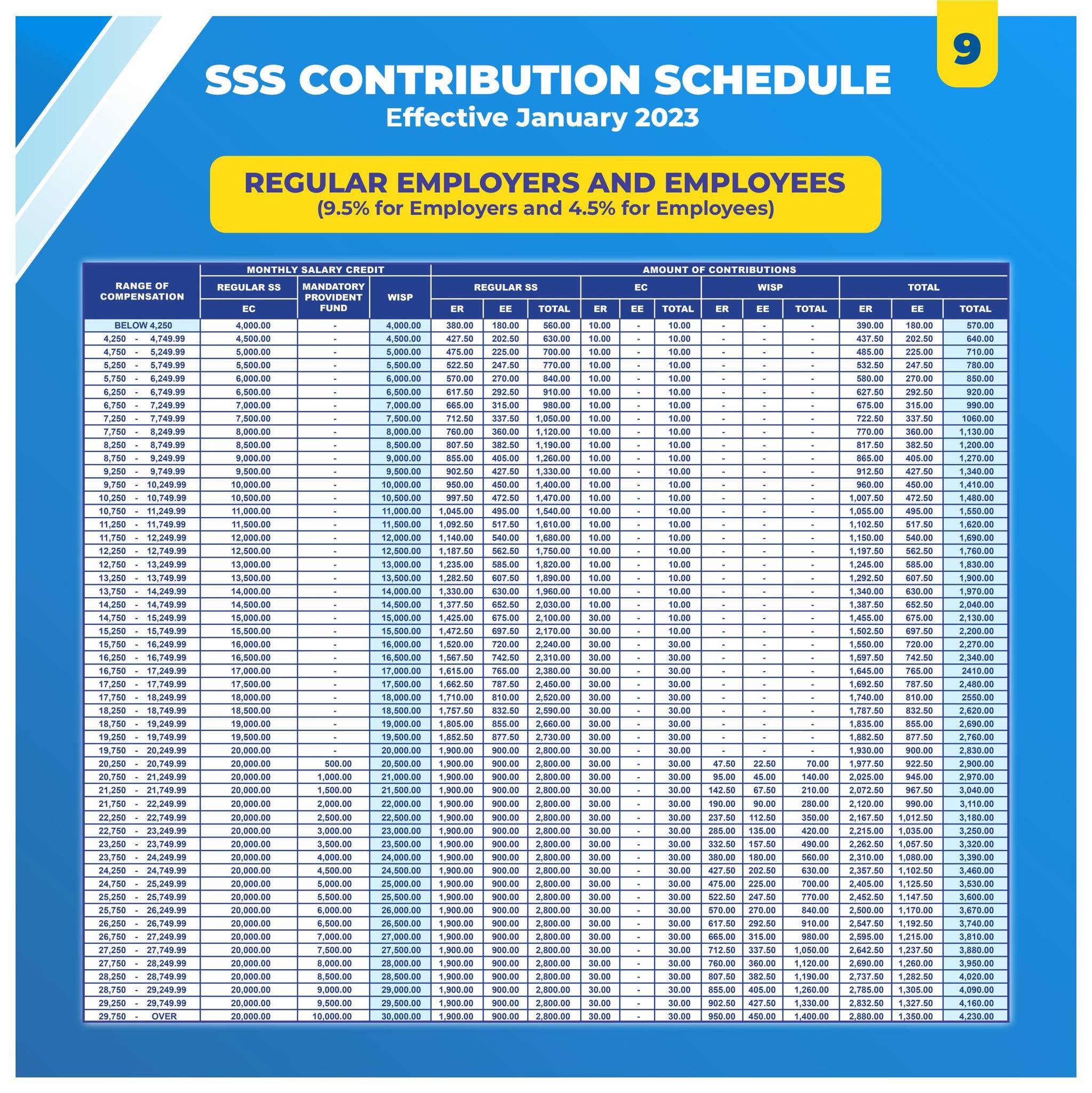

Social Security Max 2025 Deduction Daisy Therese, Calculating your social security system (sss) monthly contribution is essential for ensuring your future financial security and accessing benefits such as.

Max Social Security Contribution For 2025 Pepi Trisha, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

Social Security Tax Max 2025 Alikee Celestyn, The maximum social security benefit in 2025 is $3,822 per month at full retirement age.

New SSS Contribution Table 2025 Schedule Effective January, The maximum contribution for social security taxes in 2025 is set at $9,932.40, with the maximum.

2025 Irs Maximum 401k Paige Loleta, The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 is $10,453.20 ($168,600 x 6.2%).

Max 401k Contribution With Catch Up 2025 Alia Louise, Stay updated with the new sss monthly contribution rates for 2025.

Travel Hiking WordPress Theme By WP Elemento